Can also be College loans be used to Pay rent?

All you have to Discover

- If you’re towards the university, the school often automatically deduct area and you will board from your own mortgage balance per month otherwise semester

- The capability to pay for book or other houses expenses stretches in order to both government and personal figuratively speaking

- When you get a student loan, the funds try delivered to the school you may be going to, never to your

Articles

College loans are often used to pay for book. On the other hand, you can make use of funds from student loans to cover most other cost of living, such as food and transportation.

But not, you can find constraints you need to know. So on this page, we will simply take an intense dive into you skill having your education loan and how to have fun with student loan money for lease or other very important can cost you.

The new Biden Administration’s student loan forgiveness plan has been paused by the a national is attractive judge. For the moment, when cost management, the safest course is always to thinking about paying everything back.

How do you Purchase Rent Playing with Figuratively speaking?

Your own involvement when you look at the paying your own rent having college loans depends on what kind of property you live in. Instance, if you live on campus, the college tend to automatically subtract area and you can panel from the loan equilibrium every month otherwise session.

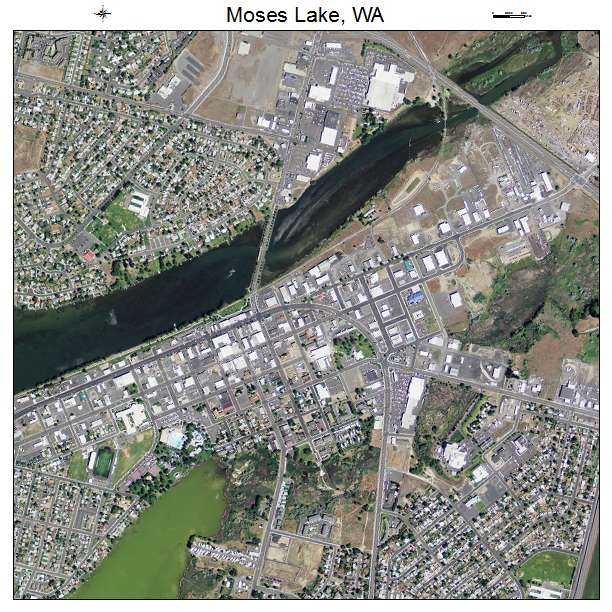

As an alternative, when you are way of living out of campus for the a property otherwise flat, you can always lead to move the amount of money for the property manager individually.

You should observe that the capability to buy lease or other housing costs gets to each other government and personal pupil loans. It means you need to use federal student education loans or individual student financing to cover area and you will board, such as the cost of an off-university apartment otherwise domestic.

However, you’ve still got to remain for the construction allocation given by your own college. Due to this you will understand how their student loan was disbursed, to help you budget properly.

Yes. Federal student support, otherwise FAFSA student loans, security housing costs, if or not your home is toward or of university. You’ll only want to be sure that you complete your FAFSA app on a yearly basis.

Exactly how student education loans is actually disbursed

First-day education loan individuals may not be conscious they won’t get the complete amount borrowed inside their bank accounts. In reality, when you get a student-based loan, the money was delivered straight to the college you happen to be browsing, never to you. This way, your own college or university can use the mortgage to fund tuition and you may almost every other expenses, along with space and you may board whenever you are residing in into the-campus houses.

Once all of the crucial university will set you back was paid off, you are refunded the rest fund remaining on financing. Then you can make use of this currency to fund rent, books and other school-associated will set you back. If you opt to live off campus, there aren’t any constraints towards the location of the household or flat.

Recall the bucks often get to a lump sum payment. Thus you will have to funds carefully to invest rent every month.

What direction to go whether your education loan disbursement was put off

It can be tiring if you would like loans and your college or university was delivering longer than expected to disburse these to your. This is particularly true if you need to purchase away from-university casing, as personal check cashing near me most landlords need security places in addition to first and you can past month away from lease upfront.

Financial aid divisions commonly disburse education loan currency following educational year has recently began. It is best to create a contingency decide to account for postponed disbursements. This plan can include saving cash away from a part-date employment to fund initial leasing costs or taking a good roomie to reduce their construction expenditures.